What would YIMBY housing success in Hawaii look like?

Like it or not, and we don't, YIMBY's are winning a lot of victories around the country for their deregulatory approach to housing. That means we can see how well those policies actually work to make things affordable. YIMBY's have a few examples they love using to show their success. They don't hold up to scrutiny.

YIMBY for those unfamiliar is an acronym for "yes-in-my-backyard". It's an approach to solving our housing crisis that believes that the main reason, sometimes the only reason, we face a housing crisis is government regulation.

It is the ascendant approach to solving our housing crisis--across the CONUS and here in Hawaii. Locally several organizations have popped up to specifically to push YIMBY talking points: Housing Hawaii's Future, HIYIMBY, and Holomua Collective. Several other organizations like Grassroots Institute and HI Appleseed have also jumped on the YIMBY bandwagon.

YIMBYism is a very popular political program with property developers because it says that what governments should do is let property developers do whatever they want. So developers have funneled a lot of money to YIMBY groups.

Because of their rising political power, YIMBY's are starting to notch some wins in major cities across the US and abroad. And YIMBY's have some favorite examples to point to their successes.

In no particular order these are:

- Auckland, Aotearoa eliminated single-family zoning (2016)

- Minneapolis, MN eliminated single-family zoning (2020) and parking minimums (2021)

- Spokane, WA eliminates single-family zoning (2022)

- Houston, TX reduced minimum lot sizes to 1,400 sqft (1998 partial and 2013 city-wide)

- Austin, TX eliminated parking minimums (2023) and single-family zoning (2023)

- San Diego, CA ADU bonus program (2020)

There is no doubt that YIMBY's view each of these as only a partial success. Nowhere has enacted the full slate of deregulation of building codes, zoning laws, safety rules, torte law reforms immunizing developers, and simultaneously a robust, no strings attached package of financial supports for developers via low interest loans, grants, and tax credits.

Be that as it may, in the policy world each reform should be expected to do some good and YIMBY's certainly claim their reforms have done just that. It is fair to look at these and guess at what YIMBY reforms would accomplish in Hawaii.

YIMBY's promise affordability and they claim that these reforms are bringing just that. There are lots of squishy ways to define that, but at Hawaii LIMBY we use a very simple test for progress towards that: rents and home prices should decrease, at least in proportion to incomes. That's not what is happening.

Auckland, Aotearoa

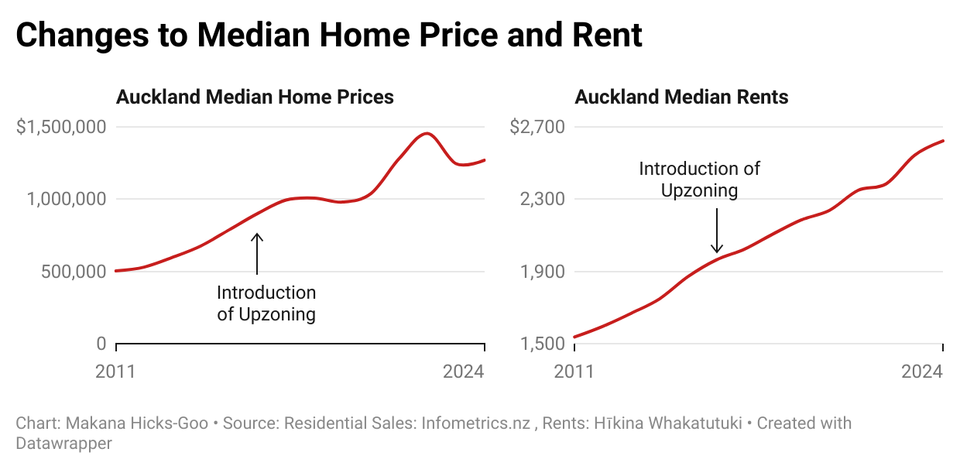

In Auckland, Aotearoa inflation adjusted rents have risen every year since upzoning. While they did briefly rise slower, rent growth has since rebounded to new heights.

Ten years after their reforms, rents in Auckland are 20% of median incomes (about where they were in 2016 at 21% of income) and rising.

If this is what success looks like then, in the best case scenario, the tens of thousands of Hawaii families who can't afford current rents can expect to be able to sometime within the next 50-100 years. By that time we expect most of them will be buried in a Las Vegas cemetery.

Minneapolis, MN

The bottom line in Minneapolis is that real (i.e. adjusted for inflation) gross rents are rising in Minneapolis and rising faster than peer cities that didn't adopt YIMBY reforms.

YIMBY's are quick to pull data from private rental websites like Zillow, AparmentList, and Apartments.com to show that Minneapolis rents are falling and especially that rents are falling while in nearby cities they're rising.

Not quite. Here's the problem, all those private sites have biased datasets which they admit themselves. It's because what gets listed there tends to skew towards the high end of the market--not to the average.

We aim to estimate median rents for new leases across the entire market. However, online marketplaces (including ours) don’t provide a fully-representative sample of each market’s true housing inventory. - AparmentList rent estimate explainer

What's more rents as reported by these sites don't actually reflect renter costs because of utilities. Every renter knows that each property comes with a different set of expectations for what part of utilities the renter pays.

The best source, one that accounts for all of that, is median gross rents reported by the Census annually via the American Community Survey. And it shows the exact opposite of what YIMBY's claim.

Spokane, WA

Looking at Spokane, WA we do not see much improvement either. In fact, if all you want to do is point to a line chart and claim credit for it (as YIMBY's are quick to) you'd have to conclude that the YIMBY reform has made things worse.

The share of rent burdened households has increased in Spokane since the 2022 reforms. More people struggling to make rent is hardly an affordability win.

One year is of course not a lot of time to get anything done, but that it's been such a flat year contradicts the narrative YIMBY's were quick to claim; that YIMBY reforms were making Spokane cheaper. There is, as of now, no evidence it is.

Houston, TX

Houston's widely lauded for reducing minimum lot sizes. This has resulted in a tens of thousands of townhomes being built in what were single-family neighborhoods. So far so good, and all true. Where it collapses is when YIMBY's leap from the observation that more homes were built to increased affordability.

The first thing to note is that even though you can now put up to 5 townhomes where a single family home once stood and that developers are doing so all across Houston, those townhomes are not necessarily cheaper than the homes they're replacing.

Townhomes are, often as not, more expensive than single-family homes in Houston. That makes them an unlikely candidate to be driving an affordability revolution.

The second thing to note is that while Houston is still nominally affordable, it's gotten substantially less affordable over the past decade. Homeownership rates are down and the number of rent burdened households is rising.

And the final point here is that Houston is famously sprawling, one of the lowest density cities in the US. That sprawl is why many researchers believe it's affordable.

This is, in some respects, the exact opposite of what YIMBY's claim. YIMBY's tend to believe that single-family homes are the bane of affordability and infill density the answer. But Houston has low cost housing arguably for one reason: it has sprawled across hundreds of square miles of low-cost floodplain and swamp.

Austin, TX

Austin's reforms are too recent to show up in Census data, so we don't really have a good metric to evaluate them by just yet. Since we don't have good data, and since rental markets are cyclical anyway, we can't really say how things are going. Given the other examples the chances are not much has changed.

But YIMBY advocates tend to rely on private market sources which are available to show that rents are falling. That more real-time availability is a great asset for looking at rental markets. It comes with a big asterisk though. As we mentioned for Minneapolis, these sources are not exactly reliable.

Below we have compiled rental estimates from a variety of popular online sources. They show that there is no agreement among these private sources as to what rents actually are. There is little insight about the broader rental market to be gained from relying on them, they don't even agree among themselves.

With rental estimates varying by as much as 43% from these sources we think it's fair to say they're unreliable. You could just as easily construct a time series to show rents shooting up as you could use these to "prove" that YIMBY reforms have lead to any sort of rent decline.

While it's not clear that most of these sites try to create a representative sample, ApartmentList—one of the more frequently cited—does. They note that at base their data is inaccurate and the Census's American Community Survey more representative:

However, online marketplaces (including ours) don’t provide a fully-representative sample of each market’s true housing inventory. Instead, they tend to skew towards newer and more-expensive apartments while underrepresenting older, cheaper units in lower-income neighborhoods....The American Community Survey is the gold-standard when it comes to capturing fully representative data that ecompasses the entire U.S. ACS rent estimates reflect all types of rental housing, from high-end luxury units to single-family rentals to public housing. — ApartmentList "Introducing the New Apartment List Rent Estimate Methodology"

Accordingly, they do try to account for this and use 2015 base ACS estimates and statistical methods to attempt to match ACS data—just in a more real time fashion.

This would be very useful. They don't consistently succeed. In Austin, TX they have consistently underestimate rental costs vs. the ACS 1-year gross median rent.

Gross rent is a better estimate of rental burden because it normalizes for when a unit includes utilities in the monthly rent vs. when it does not. That may account for some of the difference—you can disguise a rental increase if you just unbundle utilities from the rent.

ApartmentList reports "Overall", 1 bedroom, and 2 bedroom rents in their estimate. We use 1 bedroom rental estimates below because Austin's construction boom has most been one bedrooms. Since 2017, there has been a greater percent increase in the number of one bedrooms than other unit types. So presumably the impact of new supply on costs would be felt most in the market for one bedroom apartments.

As mentioned ApartmentList steadily underestimates Austin median gross rent. But critically, the underestimation gets a lot worse just as the ApartmentList data starts showing rents decline.

As we led with, it's really too early to tell reliably what impact Austin's reforms have had. But this data should give us pause. It seems reasonably likely that bias in private rental market data accounts for a lot of Austin's apparent fall in rents.

And even if Census data for 2024 catch up, it's not clear that the construction boom will lead to a long term fall in rents. Indeed, there is evidence that developers are already pulling back. Which would mean that the supply boom relief is quite possibly temporary.

San Diego, CA

San Diego has what seems at first blush a genuinely good program. They've allowed for a large number of income restricted ADU's to be built. So many that YIMBY's have been calling it an "infinite housing glitch".

The problem is despite income limits, developers can rent these units at rates far above the market. Most ADU's are smaller studio or 1-bedroom units and there you can charge as much as 24% more than the median market rate.

As for whether or not this is allowing affordability elsewhere, well less than 10% of San Diego residents can afford the median priced home.

So there you have it. A collection of YIMBY "success" stories that turn out to be nothing of the sort. At best you have very moderate reductions in rent on the order of 1% a decade. At worst you have the problem being exacerbated.

If those cities are what a YIMBY success looks like, let's hope Hawaii is a YIMBY dud.