Why do they keep doing this?

Last week Pew Research released a little blurb in dire need of some copy editing. Most of what we post needs copy editing too, but we don't have a budget, so it's fair to complain.

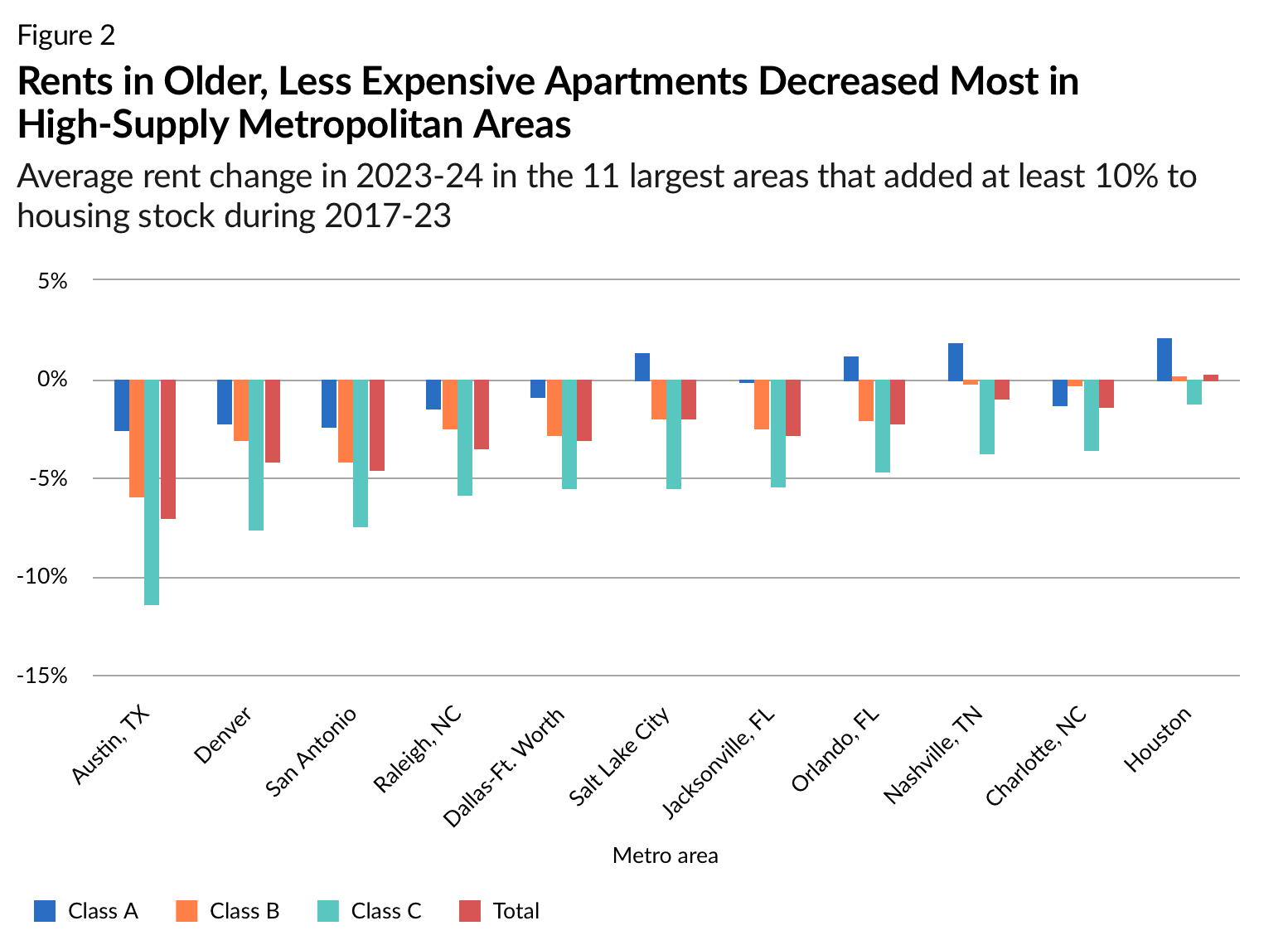

Pew went and looked at cities that added to their housing supply and then used RealPage rental data to estimate that for cities who added 10% to their housing stock between 2017-2023, rents went down 10% in 2023-2024.

Missing data much?

Here's the first issue. Those timelines don't add up. Measuring the change from 2023-2024 and ignoring what happened from 2017-2023 is opportunistic at best and deceptive at worst.

Let's just look at one city, Austin Texas, since again we don't have a budget. Austin is also the darling child of folks pushing for the sort of reform Pew says made this rent decline possible. This is the table Pew is showing us:

| Year | Change in Housing | Annual % Change Contract Rent |

|---|---|---|

| 2024 | 1.43% | -7.00% |

| 2023 | 1.43% | |

| 2022 | 1.43% | |

| 2021 | 1.43% | |

| 2020 | 1.43% | |

| 2019 | 1.43% | |

| 2018 | 1.43% | |

| 2017 |

Now I made the simplifying assumption that housing growth was the same every year, but that's not the point. The point is that the annual rent change column is basically all blank except for the last year.

It's pretty sensible to ask what values go in all those blank spaces. To do that, we can whip out table B25058 from the US Census American Community Survey. We'll use their one year estimate of median contract rents.

Here's what that table looks like:

| Year | Contract Rent | % Change Contract Rent | Cumulative from 2017 |

|---|---|---|---|

| 2024* | 1500* | -7.00% | 34.54% |

| 2023 | 1613 | 12.25% | 44.66% |

| 2022 | 1437 | 9.95% | 28.88% |

| 2021 | 1307 | 9.74% | 17.22% |

| 2020 | 1191 | 0.17% | 6.82% |

| 2019 | 1189 | 2.41% | 6.64% |

| 2018 | 1161 | 4.13% | 4.13% |

| 2017 | 1115 |

Here we added a column to show the cumulative rent change since 2017 since Pew wants to measure the cumulative change in housing stock since 2017.

This kinda changes the narrative doesn't it? "Cities that increased their housing stock by 10% still saw rent increases of 34.5%" is not a nice tidy story. It's hardly the sort of thing you'd expect if all we need to do to get lower rents is listen to YIMBY Action.

Of course correlation isn't causation so we're not claiming there is an equality there (unlike Pew which seems to really want you to make that correlation=causation link). When you look at things comprehensively, it's at the very least quite messy.

Note, we estimated the 2024 rents using the 7% overall decline that Pew uses for 2024. The Census won't have 2024 data ready until September of 2025. When they do release it, it may well disagree with the RealPage rent decline. That leads us to the second point.

Is RealPage a good data source? Betteridge's law of headlines says "no".

We've written about this before. Private market rental data is unreliable: it's a skewed sample. Census data is the most comprehensive source and by far the most accurate and usually disagrees with private company estimates.

We can run a quick spot check on how likely RealPage is to be accurate here by comparing their past claims about rental changes in Austin to the Census's. It doesn't line up well. Here's RealPage back in 2024, reflecting on 2023.

For example, the nation’s rent change laggard – Austin – cut rents 6.0% in 2023, while inventory growth in the Texas capital expanded 6.0% in 2023. - RealPage 4Q2023 report

However, Census data show that rents actually increased by 12% in 2023. RealPage was 18 points wide of the mark. That's absolutely massively wrong.

Unfortunately, private market data is available far more readily than Census data. So anyone can cherry pick unreliable data for almost a full year before there's any correction. Akamai readers should beware.

This isn't a post about upzoning or reforming zoning. That makes a lot of sense a lot of the time. But the pat causation folks want to see between increased supply and falling rents, just isn't there. Even the most rigorous peer reviewed studies haven't found that: instead they've found at best that rental growth slows. But it still grows.

We want a Hawaii that is affordable for all locals. To get there, we think we need to see actual declines in housing costs for locals. Using bad data to make it look like one set of policies caused a rental decline that never happened, isn't productive.